Target Corporation (TGT) recently reported decent revenues coupled with earnings that fell short of market expectations as the company continues to face a challenging retail environment and fierce competition. The debate about the company's place in the marketplace rages on as the road ahead remains difficult (and potentially painful) despite ongoing efforts to differentiate the brand.

However, rather than focusing on the company's financials and operations, which have been well documented by other contributors, we turn our focus for a moment to the rather more obscure proxy statement and the share ownership of the company's board of directors. In particular, the lack of direct and indirect ownership of the company's shares even by longstanding directors.

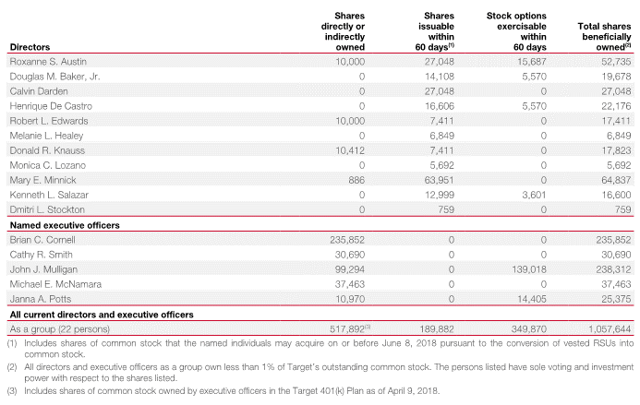

Target is not alone in having directors with limited personal investment in the company. However, Target's board members take this lack of personal investment to an unusual level in that seven of the eleven nominees for the company's board of directors have no personal ownership of the company's shares on either a direct or indirect basis. In essence, even the smallest Target shareholder has invested more personal funds into the company's shares than the majority of the company's board of directors.

Source: Target Proxy Statement (2018)

The lack of direct or indirect ownership of company shares purchased with personal funds, as noted earlier, is not an issue limited to the company. A lack of direct investment by board members can be identified at many other companies. In many cases, the shareholding disclosure in the proxy statement is structured in such a way that direct and indirect individual ownership is not specifically separated from ownership through stock grants and restricted stock units (as is the case with Target's disclosure), thus obscuring the nature of ownership and requiring investors to go to the fine print notes associated with the tables to understand the true nature of share ownership.

However, the extent of the lack of direct investment at Target by its board members is striking, and it's not simply an issue of directors new to the board. In fact, the majority of the seven directors with no personal investment in the company have been board members since 2013 and one - Calvin Darden - has sat on the board for nearly 15 years.

Target does currently have stock ownership guidelines for directors (and executive officers), but in our experience, these are only marginally meaningful. The current stock ownership requirement for directors is a fixed value of $500,000, but this level of ownership may be achieved over a period of five years after election to the board and, based on the compensation paid to directors, is conveniently significantly less than what a director will earn in fees over the same five-year period. The company therefore establishes a requirement - and then effectively fulfills that requirement over time out of company funds.

We find the structure of this arrangement, though not unusual in the corporate world, nonetheless concerning and especially so in light of the lack of direct ownership. A significant body of evidence - as well as common sense - supports the view that individuals (and board members) tend to react differently when making decisions when there is a personal investment (made with personal funds) versus an indirect investment developed through the granting of stock grants or stock options. The difference is similar to the psychological difference between risking personal funds or "house" funds. A lack of direct personal investment has the potential to result in decisions which don't reflect the best interests of shareholders as the psychological alignment does not reflect the apparent financial alignment with common shareholders.

In addition, it begs the question exactly what message is sent to the public markets on the margin when the members of a company's board of directors don't see sufficient reason to invest directly in the shares of the company of which they are a director.

It's difficult, of course, to assign a particular decision or fault to the lack of direct ownership of stock on the part of the board of directors. We're also not suggesting that the board of directors has implicitly failed in its duties with respect to shareholders. Individual shareholders may have their own perspective on these issues.

Nonetheless, shareholders may be better served by including a minimum direct investment requirement before an individual may be nominated to the board of directors, such as a fixed threshold of $100,000 in company stock in addition to the $500,000 five-year requirement, to ensure that individuals being nominated to the board have an actual, personal, tangible investment in the company however small relative to the scale of the company. A minimum investment threshold before an individual is eligible for nomination is not an unusual requirement. We've previously communicated these concerns to the company without receiving a satisfactory response.

ConclusionWe believe there is a compelling investment argument for Target despite the ongoing competitive challenges. We believe the company is making the right moves in several areas, especially with respect to its exclusive brands, to remain relevant and differentiated in the new retail landscape. We're also not a subscriber to the conventional wisdom that physical retail is dead in the face of online competition. Indeed, we've argued that the growth of Amazon (AMZN) over the last several years isn't unprecedented and, at least so far, actually rather closely tracks (and possibly underperforms) the retail market share capture achieved by Walmart (WMT) more than two decades earlier. Regardless, our view is that the company will remain profitable and, at the right price, represents a decent long-term investment.

However, from a governance perspective, we do believe that Target shareholders should be concerned about the lack of personal investment by those who purport to represent the interests of the company's shareholders.

Disclosure: I am/we are long TGT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment